Following publication of the 2022 Annual Survey of Hours and Earnings (ASHE) on 26th October, it has come to our attention that the reclassification of the Standard Occupational Classification (SOC), may, in some instances, result in a delay in the calculation of periodical payments due to be paid to Claimants from the NHS.

The periodical payments that are affected are those that are:

- The periodical payments that are affected are those that are:

indexed in line with the ASHE 6115 earnings index (or equivalent thereafter following reclassification), this being for “care assistants and home carers”, and - have previously undergone reclassification in 2011

We understand that the NHSLA is taking steps to seek direction from the Court and for an amendment to be made to the model Order. We understand that this will not be to the detriment of Claimants; it will simply result in a delay in paying the full amount of the annual periodical payment.

We understand that, in the meantime, the NHSLA plans to make ASHE-linked periodical payments either:

- In the same sum as paid last year; or

- In the increased/decreased sum recalculated in accordance with the relevant data for last year where in 2022 the annual sum was due to be increased or decreased or commenced.

Any balancing payment to reflect the indexation uplift will then be made once they are satisfied that any issues are resolved.

At this stage, we are not aware of a similar stance being taken by insurers or other defendants, who might take the view that the model in its current form is sufficient.

Technical detail

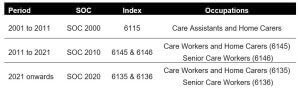

By way of background, the Office of National Statistics (ONS) reclassifies data every ten years, last having done so in 2011. The purpose of reclassification is to ensure that the published data properly reflects the ever-changing structure and composition of the labour market. The SOCs, and the ASHE index equivalent to 6115 following reclassification, in recent years have been as follow:

Whilst the 6115 earnings index has technically changed following each reclassification (for example being split into two occupational groups in 2011), the ONS continues to publish combined equivalent data in a bespoke table each year, ensuring continuity with 6115 is maintained.

However, moving from one SOC basis to another does still represent a break in the ASHE time series, and earnings data from one SOC is not directly comparable with data from another. In other words, earnings data from 2021 cannot be directly compared with, say, data from 2022.

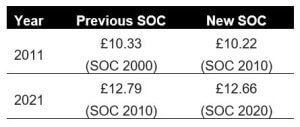

By way of illustration, the following shows the difference between the hourly rate of pay at the 80th centile of ASHE 6115 (or equivalent) under each SOC, in each year in which reclassification has occurred:

Many Orders that predate 2012 were not equipped to deal with these reclassification events, and this led to the NHSLA reopening the test case, RH v University Hospitals Bristol NHS Foundation Trust, to find a solution to this issue. The outcome was a new model Order featuring provisions to deal with the 2011 reclassification event, as well as those in future years. The model was recommended by Mrs Justice Swift and applied to all affected NHSLA (and most non-NHSLA) cases. The model has subsequently been used as the template for the majority of cases settling since then.

In essence, the provisions in the model Order serve to rebase the value of the annual periodical payment in line with the year of reclassification, crystallising any indexation applied up to that point under the current SOC. Any future indexation is then applied to this rebased sum using the new SOC.

Under the terms of the existing model Order we consider that it is possible to properly account for the latest reclassification event (2021) and to successfully perform the necessary calculations to establish any sum payable to a Claimant, much in the same way as the 2011 reclassification was dealt with.

However, whilst the model Order expressly sets out a formula for performing the necessary rebasing exercise upon the first occurrence of reclassification, dealing with any second and subsequent reclassification relies upon correct understanding and application of the relevant wording within the Order. It is not explicit regarding one element of the calculation, hence the reason for seeking direction from the Court.

Failure to correctly interpret the Order and apply accurate methodology may lead to erroneous calculations being carried out, and incorrect payments therefore being made to Claimants.

For an experienced, impartial view on periodical payments, personal injury trusts, investment of lump sums, and entitlement to state benefits, please telephone one of our specialist advisers on 0800 082 1216. We will be happy to have a no obligation discussion, or e-mail us at: picop@chasedevere.co.uk or visit our website at www.chasedeverepicop.co.uk

The Financial Conduct Authority does not regulate deposit accounts, Personal Injury Trusts, Periodical Payment advice, Taxation and Trust advice.